01.12.2022

27'

Section 1446(f) and New QI Agreement

The new Section 1446(f) regulations include new withholding and reporting requirements regarding transfers of interests in publicly traded partnerships (“PTP”) and non-publicly traded partnerships (“non-PTP”).

Basis for the regulation are the final Section 1446(f) regulations which came into effect on January 29, 2021. Pursuant to Notice 2021-51, the provisions referring to PTPs and the withholding responsibilities of partnerships will come into force on January 1, 2023, the date when the final version of the new, not yet finally published Qualified Intermediary agreement is expected to be in force.

This information focuses first on the impact the new regulation has on a broker that is a Qualified Intermediary (QI), and second on some implementation options for Swiss QIs.

Please note that not all questions arising from the regulation have been answered yet. For example, the fact that there are no presumption rules when classifying a PTPs as in- or out-of-scope is severely limiting. We are outlining below in as much detail as possible what has so far been clarified but are aware that many implementation challenges are still open to interpretation and clarification. This leads us to believe (and hope) that the IRS might grant some much-needed last-minute relief in the form of an additional extension, a good-faith period or in the form of a reduction of scope, similar to what we have seen with Section 871(m).

The new QI Agreement will have to be signed by QIs next year. We will provide detailed instructions on how to do so in a separate information when the time comes.

1. Background and Treatment of PTP and non-PTP interest until December 31, 2022

Publicly traded partnerships (“PTPs”) and non-publicly traded partnerships (“non-PTPs”) are an attractive form of investment especially in the U.S., because for U.S. tax purposes partnerships act as tax transparent vehicles. This treatment generally exempts them from taxation on the partnership-level; instead, distributions are paid in gross to the investor, providing the benefit to them of only being taxed once. This is less the case with publicly traded corporations, which are taxed twice (for profits at the corporate level and for dividends at the shareholder level). Additionally, the investor may be able to fully benefit from tax treaty benefits or other exempt statuses when investing in a tax transparent vehicle because no taxes are paid on an accumulated basis on the partnership level. There are some caveats though. An important one is that foreign partners investing in certain PTPs and non-PTPs must file a U.S. tax return and attach copies of tax forms issued to them by the partnership (e.g. Schedule K-1, Form 8805) to claim for a tax refund with the IRS, if the partnership has Effectively Connected Income (ECI). Generally, when a foreign person engages in a trade or business in the United States, all income from sources within the United States connected with the conduct of that trade or business is considered to be ECI. ECI is usually not Fixed, Determinable, Annual or Periodical (FDAP) income, which is commonly known as U.S. reportable amount in the QI space and withheld on by QIs. One regulation that has been in effect since many years is the 1446(a) regulation, which requires a partnership to withhold at a certain rate on ECI paid out to non-U.S. partners.

Non-PTPs

Securities structured as non-PTPs are often alternative investments such as private equity. Same as with PTPs, distributions from non-PTPs to foreign partners deemed ECI under Section 1446(a) must be withheld by the non-PTP at 37% tax rate for noncorporate partners (or 21% for corporate partners) and reported on forms 1042-S to the broker or the investor.

Brokers generally invest in non-PTPs by signing a subscription agreement without involvement of an upstream custodian or an established securities market. Non-PTPs are also business organizations treated as partnerships for U.S. tax purposes and have commonly tax forms (K-1 and 1042-S) issued to their partners via an appointed agent. Depending on the documentation provided to the non-PTP when subscribing, the tax forms are issued to the broker or to the beneficial owner of the partnership instrument.

PTPs

PTPs are business organizations treated as a partnership for U.S. tax purposes whose securities are regularly traded on an established securities market. Many PTPs invest in the energy sector in the USA, such as crude oil and natural gas extraction, or in U.S. real property.

So far, Swiss brokers generally held PTP interest through their custodian for U.S. assets in segregated accounts acting in a Nonqualified Intermediary (NQI) capacity. Forms Schedule K-1 and 1042-S were issued to either the broker or the beneficial owner of the partnership interest, based on the documentation submitted to the U.S. upstream custodian acting as nominee for the partnership interest. Distributions from PTPs to foreign partners deemed ECI under Section 1446(a) must be withheld by the PTP at a 37% tax rate for foreign noncorporate partners (or 21% for foreign corporate partners) and reported via a Form 1042-S with income code 27 to the broker or the investor. When the PTP issued a qualified notice, the withholding responsibilities shift from the PTP to a nominee who must be a U.S. withholding agent holding an interest in the PTP on behalf of the foreign partner. Qualified notices contain withholding information on the distribution, such as the breakdown of the ECI and non-ECI (i.e. FDAP income) components of the distribution, and the foreign or U.S. sourced portions of the distribution.

2. Summary of the New 1446(f) Regulation and the Changes to the QI Agreement

As a result of 1446(f), not only income distributed by partnerships is subject to withholding, but newly also a transfer of an interest in a partnership. For purposes of 1446(f), the term transfer means a sale, exchange, or other disposition, and includes a distribution from a partnership to a partner, as well as a transfer treated as a sale or exchange.

In case of a non-PTP, the transferee (essentially the “buyer”) of the interest, and, in case of a PTP, the broker, must generally withhold 10% tax of the amount realized on the gross proceeds on the settlement date of the transfer, based on the tax status of the transferor (essentially the “seller”) on the trade date.

In summary, Section 1446(f) will largely require that

as of January 1, 2023,

someone in the investment chain (either a transferee, the partnership, or a broker) must apply a 10% withholding tax,

on the gross proceeds of sales and exchanges and on certain distributions of in-scope PTPs and non-PTPs (whether the partnership is U.S. domiciled or not)

from non-U.S. transferors (absent other exemptions).

The QI Agreement will be updated as well to accommodate the new section 1446(f) regulation, thereby enabling QIs to apply section 1446(f) withholding on the amount realized and section 1446(a) withholding on ECI distributed by PTPs. So far, 1446(a) withholding could only be assumed by U.S. brokers or the partnerships. As of January 1, 2023, QIs will be able to choose to act in the following capacities for section 1446(a) and 1446(f) purposes:

Primary withholding agent,

Disclosing QI and

QI not acting as disclosing QI (“Non-disclosing QI”).

QIs can also, notwithstanding their QI Status, opt to act as NQI for the investment.

Depending on the capacity chosen, different obligations will be imposed on the brokers regarding the documentation they provide to upstream intermediaries, and their withholding and reporting responsibilities. Also, with the proposed QI Agreement, a completely new obligation will be introduced to QIs which is the obligation to assume nominee reporting responsibilities.

The proposed QI Agreement does not cover the treatment of non-PTPs.

As of the date of this information, there is still no final version of the QI Agreement available.

3. In-Scope Test

The regulations do not define when a partnership (whether PTP or non-PTP) is in-scope or out of scope for 1446(f) withholding. Rather, they define exemptions when specific withholding does not need to be applied. There are withholding exemptions on a partnership-level which indirectly allow a partnership to classify as “out-of-scope” for the section. Some exemptions only apply on a partner level, which means the partnership may be in-scope for 1446(f) but no withholding applies because the partner is exempt from withholding.

| Tax Exemption possible if | Applicable to PTP | Applicable to non-PTPs |

|---|---|---|

| Partnership-level exemptions | ||

| Certification (such as qualified notice issued by the partnership within the 92-day period ending on the date of the transfer) that partnership was not engaged in a trade or business within the U.S. | ✕ | ✕ |

| Certification of no Section 751 income: Transfer of the partnership would not result in any ordinary income. | ✕ | |

| Certification (such as qualified notice issued by partnership within the 92-day period ending on the date of the transfer) that effectively connected gain on hypothetical sale of partnership assets is either < 10% of total gain or none | ✕ | ✕ |

| Certification (such as qualified notice issued by partnership within the 92-day period ending on the date of the transfer) that an excess portion of the distribution is not deemed an amount in excess of cumulative net income | ✕ | |

| Partner-level exemptions | ||

| Certification of no realized gain: transfer of the partnership interest would not result in any realized gain | ✕ | |

| Transferor is a U.S. Person documented with a Form W-9 | ✕ | ✕ |

| Transferor is a securities dealer and is documented with a Form W-8ECI certifying that any gain on the PTP sale is ECI | ✕ | |

| Certification that the non-U.S. transferor was partner in the non-PTP for the prior tax year and the preceding tax year and, in each of those years, his share of ECI was less than 10% of the transferor’s total distributive share of gross income received from the partnership, and less than USD 1 million | ✕ | |

| Non-U.S. transferor is documented with a valid 0% treaty claim and the partnership does not have a permanent establishment in the U.S. | ✕ | ✕ |

| Amount realized is subject to backup withholding | ✕ | ✕ |

| Certification of non-recognition: non-recognition provision allows the transferor not to recognize any gain or loss with respect to the transfer | ✕ |

The way the regulations define whether a partnership is in or out of scope severely limit the application of a set of predetermined rules to steer the impact the regulation has on a broker, especially in the PTP-universe. Even if a partnership is not in scope because, for example, it does not engage in a trade or business within the U.S., a broker cannot presume that, but must instead rely on a certification (usually in the form of a qualified notice) issued by the partnership which confirms to the fact. The regulations do not provide for brokers to apply presumption rules which would allow a broker to predetermine an exempt status of a partnership (e.g. by reviewing a termsheet). This requires brokers to broadly apply 1446(f) withholding absent a qualified notice if the partner is not exempt from withholding, even if the broker has actual knowledge that the partnership is not in scope. As a result, the exchange of information between partnerships, brokers and transferees, and therefore the role of financial information vendors (such as e.g. SIX Financial Information), become of significant importance.

It is also important to note that the regulations do not carve out non-U.S. partnerships from the responsibility to apply 1446(f) withholding. A non-U.S. partnership with a non-U.S. general partner has the same 1446(f) requirements as a U.S. partnership and must also issue qualified notices if they want to prevent downstream withholding.

4. Treatment of non-PTPs under Section 1446(f)

Pursuant to the final 1446(f) regulations, a transferee of a non-PTP interest must generally withhold 10% tax on the gross proceeds of a sale, exchange, or other disposition, if any portion of the gain would be treated under section 864(c)(8) as effectively connected with the trade and business within the United States.

When a transfer occurs, non-PTPs will be required to report the transferors TIN (a U.S. TIN, irrespective of the transferor being a U.S. person or not!) on a Form 8288-A. The IRS will subsequently stamp the transferor’s copy of Form 8288-A to show receipt and mail this copy to the transferor who will use this copy to claim a credit for amount withheld on their U.S. tax return.

The non-PTP is required to withhold tax on subsequent distributions to transferees if the transferee did not provide a certification that the withholding obligation was satisfied, or the partnership has reason to know that the certification cannot be relied upon, or only a part of the tax due was withheld on the transfer (so-called backstop withholding). Backstop withholding is reported by the partnership with Form 8288-C.

The proposed QI Agreement has not been updated to cover the treatment of non-PTPs, which means that QIs cannot, so far, act as QI for purposes of Section 1446(f) when investing in non-PTPs.

We presume that the following will generally apply once the regulation enters into force:

Non-PTP interests are seldomly transferred from one partner to another. Rather, partners sell their interest back to the partnership, which makes the partnership the transferee and therefore the withholding agent.

The fact that transferees may not be capable to withhold, backstop withholding broadly applies which effectively means that brokers can assume that the 1446(f) withholding will generally be performed by the partnership in the non-PTP-space.

As the QI agreement as well as the related instructions and publications have not been updated to delegate 1446(f) requirements on non-PTP transfers, a QI cannot, so far, act as withholding agent on transfers of non-PTP interest and the withholding responsibilities remain with the transferee or, if backstop withholding applies, the partnership.

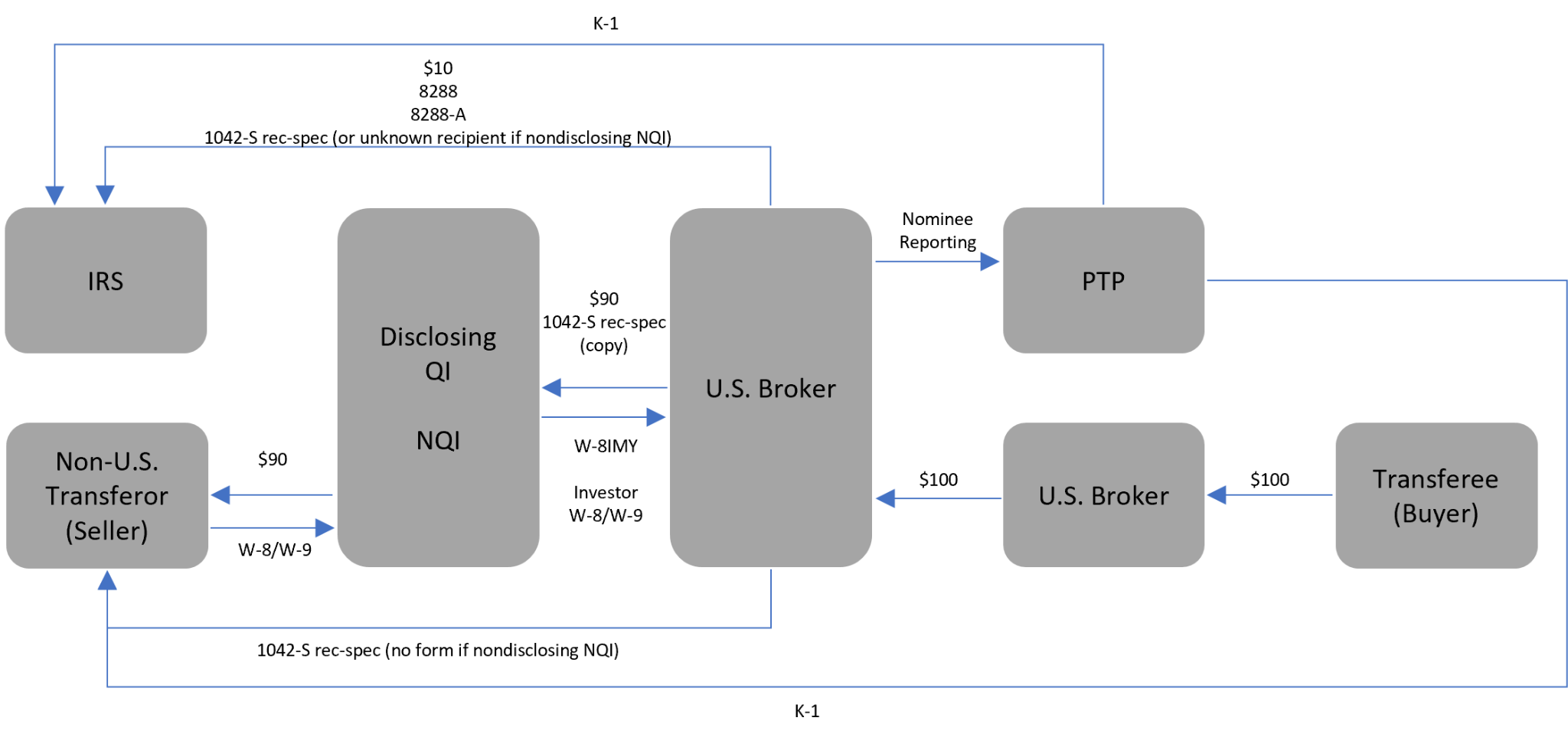

5. Treatment of PTPs under Section 1446(f)

Pursuant to the final 1446(f) regulations, a broker of a PTP interest must generally withhold. Therefore, contrary to non-PTPs, the different roles a broker can assume when investing in PTPs on behalf of investors have been incorporated in the QI Agreement. The QI Agreement allows brokers to act as primary withholding agents, in the capacity of disclosing QIs or non-disclosing QIs, or as disclosing or non-disclosing NQIs on amounts realized by a transfer of interest in a PTP. The table below summarizes the different capacities and responsibilities brokers can assume:

| Documentation | Withholding | Reporting |

|---|---|---|

| Primary QI for 1446(f) | ||

| The broker submits to the upstream withholding agent a Form W-8IMY (lines 14, 15b and 15c must be checked) and a withholding statement. The partner must be properly documented with the QI for chapter 3 and 4 purposes and provide a U.S. TIN. The primary QI acts as nominee and must submit the statement described in 1.6031(c)-1T(a)(1) with respect to the partner to the PTP, PTP agent or the broker’s nominee based on the account documentation in place. | The primary QI must withhold on the amount realized and remit the tax to the IRS on or within 20 days after the settlement date. Furthermore, a primary QI must also withhold on distributions of the PTP according to 1446(a) and remit the taxes to the IRS. | The primary QI will report the amount realized on Form 1042-S to the recipient withholding rate pool with the new income code 57. If the account holder is a NQI or an intermediary for which the QI cannot apply the joint account rule, the primary QI is not allowed to include this account in the withholding rate pool and must perform recipient-specific reporting for that account. The primary QI must also issue a separate Form 1042-S when requested by an account holder under specific conditions. In addition, the primary QI must report the tax withheld on Forms 8288 and 8288-A, whose copy must be forwarded to the PTP within ten days after the date of the transfer. |

| Non-disclosing QI | ||

| The broker submits to the upstream withholding agent the Form W-8IMY (line 14 must be checked) and instructs in the withholding statement if the PTP interests are held in a pool of tax-exempt account holders or in pool of account holders subject to 10% tax on the amount realized (a gain allocation is additionally required). The underlying partners must be properly documented with the QI for chapter 3 and 4 purposes and provide a U.S. TIN. The broker will submit the statement described in 1.6031(c)-1T(a)(1) with respect to the partner to the PTP, PTP agent or the broker’s nominee based on the account documentation in place. The broker may also appoint its withholding agent to provide the statement to the PTP. This discloses the partner towards the partnership notwithstanding the broker acting as non-disclosing QI. | The upstream withholding agent will withhold according to the withholding statement submitted by the non-disclosing QI and remit the taxes to the IRS. | The non-disclosing QI will report the amount realized on Form 1042-S to the recipient withholding rate pool with the new income code 57. If the account holder is a nonqualified intermediary (“NQI”) or an intermediary for which the QI cannot apply the joint account rule, the non-disclosing QI is not allowed to include this account in the withholding rate pool and must perform a recipient-specific reporting for that account. The non-disclosing QI must issue a separate Form 1042-S when requested by an account holder under specific conditions. |

| Disclosing QI | ||

| The broker submits to the upstream withholding agent a Form W-8IMY (line 14 must be checked), a withholding statement and every partner’s specific tax documentation, such as Forms W-8 or W-9, to the upstream intermediary assuming withholding and reporting responsibility. According to the instruction of the Forms W-8, non-U.S. clients submitting a Form W-8 to document themselves for their partnership interest are required to provide a U.S. taxpayer identification number (“U.S. TIN”) on the tax form. The broker will submit the statement described in 1.6031(c)-1T(a)(1) with respect to the partner to the PTP, PTP agent or the broker’s nominee based on the account documentation in place. The broker may also appoint its withholding agent to provide the statement to the PTP. | The upstream withholding agent will withhold according to the partner tax documentation submitted by the disclosing QI and remit the taxes to the IRS. | The upstream withholding agent will report the amount realized and the taxes withheld on Form 1042-S with the new income code 57 or Form 1099-B and send copies B of the form directly to the partners disclosed to the upstream withholding agent. In addition, the withholding party must report the tax withheld on Forms 8288 and 8288-A, whose copy must be forwarded to the PTP within ten days after the date of the transfer. |

| Nonqualified Intermediary | ||

| The broker submits to the upstream withholding agent a Form W-8IMY (line 17a and 17b must be checked) and a withholding statement Depending on the agreed setup, the broker will also submit every partner’s specific tax documentation, such as Forms W-8 or W-9, to the upstream withholding agent (“disclosing NQI”). If they do not, the broker is acting as “non-disclosing NQI”. The broker agrees in writing with the upstream withholding agent that the reporting and withholding responsibility will be assumed by the latter. The broker will submit the statement described in 1.6031(c)-1T(a)(1) with respect to every partner to the withholding agent and will appoint the upstream withholding agent as its agent to forward the statement to the PTP (or to the PTP’s agent). This means that, even if acting as non-disclosing NQI, a broker will still disclose its partners to the upstream withholding agent for purposes of the nominee reporting requirement. | The upstream withholding agent will withhold at 10% tax rate on the amount realized, irrespective of the U.S. status of the indirect account holder. no treaty benefit can be applied when the broker acts as NQI. | The upstream withholding agent will report the amount realized and the taxes withheld on Form 1042-S with the new income code 57 or Form 1099-B and send copies B of the form directly to the partners disclosed to the upstream withholding agent. If the broker is acting as non-disclosing NQI, the withholding agent will issue a Form 1042-S to an unknown recipient (irrespective of the U.S. status of the partner). In addition, the upstream withholding agent will report the tax withheld on Forms 8288 and 8288-A, whose copy must be forwarded to the PTP or non-PTP within ten days after the date of the transfer. |

6. Implementation Options

At a minimum, brokers will be required to implement processes to identify PTPs and non-PTPs, to re-document themselves with custodians and non-PTPs, and to implement changes in the IT environment in order to be able to process and, if applicable, report the withheld tax on the disposition.

Non-PTPs

There is currently no option for brokers in a role as QI to assume withholding and reporting responsibilities for purposes of 1446(f) when investing in non-PTPs. Any additional regulatory guidance that would be needed to correctly implement the regulation has been postponed. We therefore understand that non-PTPs will assume withholding responsibilities via the backstop withholding requirement, except if they have knowledge and documentation that the transferee will perform the withholding. However, the regulations do not fully relieve brokers and they will have to consider at least the following:

If a broker invests in a beneficial owner capacity, not only do they have to consider potential tax return filing obligations, but should also apply for their own TIN (other than a QI-EIN) to fulfill the non-PTP’s documentation obligations.

If a broker invests as NQI, underlying foreign investors will have to provide a Form W-8 and may be required to provide their U.S. TIN.

It is unclear if brokers investing as QIs will be possible in the future. As the QI agreement does not specify the roles a QI could have when investing in non-PTPs, brokers may still be able to continue acting as QI, however, as non-PTPs will have to now fulfill the Form 8288-A reporting requirements (if they are subject to backstop withholding), brokers will have to provide the underlying investor’s U.S. TIN to the partnership and therefore disclose the investor to the partnership. This would eliminate the advantages of the QI status.

PTPs

Brokers will have to inquire with their custodian whether the holding of PTPs is still possible and which services are offered. Some custodians have decided to limit or even abstain from offering custody of PTPs at all.

For example, SIX SIS does not offer a broker to hold in-scope securities in a primary QI, non-disclosing QI or non-disclosing NQI capacity. This limitation leaves three options for a Swiss broker when holding securities via SIX SIS:

Exit strategy

In-scope securities must be classified as such in the security master file, sold prior to January 1, 2023 and blocked within the IT system. An effective control must be implemented by the broker to ensure that no in-scope securities can be transferred in the future. It is important to note that a broker may be required to broaden the scope of what is considered “in scope”. As a PTP is only out of scope as long as they provide the broker or transferee (and, presumably, the vendor) with a qualified notice, the in-scope status of a PTP may change during a tax year. The broker may therefore be forced to exclude all PTPs from their investment universe to achieve an effective exit strategy.Invest in PTPs as Disclosing QI

The broker will open segregated accounts with the custodian, document itself with a W-8IMY and a withholding statement, and provide for each segregated account a Form W-8 (including U.S. TIN) or W-9 of the partner. The disclosing QI will generally not have any withholding or reporting responsibilities under section 1446(f). The withholding on amounts realized will be according to the documentation provided for the underlying investor and the reporting (Forms 1042-S or 1099) will be issued by the U.S. withholding agent directly to the investor.Invest in PTPs as Disclosing NQI

The broker will open segregated accounts with the custodian, document itself with a Form W-8IMY and a withholding statement, and provide for each segregated account a Form W-8 or W-9 of the partner. In addition, the NQI will provide a NQI agreement letter to SIX SIS. The NQI will not have any withholding or reporting responsibilities under section 1446(f). The withholding on amounts realized will be 10% irrespective of the documentation provided for the underlying investor and the reporting (Forms 1042-S) will be issued directly to the investor.

The main difference between acting as a disclosing QI versus acting as a disclosing NQI is that disclosing QIs have the ability to provide reduced rates of withholding to investors if they fulfill the partner-level exemptions. Compared to acting as disclosing NQI, a disclosing QI will however continue to act under the QI agreement, which means that the withholding and reporting responsibilities remain with the QI (even if acting as a “non-primary withholding and reporting agent) and the accounts held in a disclosing QI capacity remain accounts for which the QI acts as QI (which may also make them in scope for the QI periodic review at some point).

Another difference is that, according to SIX SIS, no U.S. TIN of a foreign partner must be provided by the disclosing NQI to SIX SIS. According to the Form W-8 instructions, however, a U.S. TIN must be provided by a foreign partner, a requirement we believe will be enforced by U.S. withholding agents in the future, meaning that the relief of providing a U.S. TIN by a non-U.S. investor may be only of temporary nature.

For the time being, we expect that Swiss brokers that intend to stay in the PTP-space will be least affected by the 1446(f) regulation by acting as disclosing NQI and opening segregated accounts for the partners. If the broker wants to offer a 0% rate for their U.S. investors, their best option will be to act as disclosing QI.

7. Conclusion

Currently, many Swiss brokers have decided to exit the PTP space due to potential U.S. tax return obligations and the burdensome additions to the partner documentation requirements. The new changes to the QI Agreement impose a broad requirement to obtain U.S. TINs of the non-U.S. partners which poses a new challenge for QIs and investors alike. Furthermore, the introduction of a 10% withholding tax on transfers makes the investment in PTPs significantly less attractive.

A lot of uncertainty on the obligations of QIs concerning section 1446(f) remains. As the deadline is approaching fast, we are hopeful that the IRS publishes a last-minute relief or an additional extension on the implementation date.

Swiss QIs deciding to remain in the PTP space will be required to screen their holdings for PTPs carefully and open segregated accounts for PTPs with their custodian for each partner, whereas the partner should provide their U.S. TIN to make sure they are able fulfill their U.S. tax return obligations. Independent of the capacity the broker acts for the amount realized, changes in the IT infrastructure might be required to properly deduct the 10% withholding tax on the amount realized from the client’s account.

For QIs investing only in out-of-scope PTPs, adequate monitoring procedures must be put in place to ensure that the partnership remains out of scope. Should they ever be in scope and the QI does not have procedures in place to apply withholding, there is a risk of underwithholding. If a PTP is in scope, the partner-level exemptions only grant investor-related relief. A QI will still have to have procedures in place to monitor and apply withholding irrespective of whether withholding applies.

In the non-PTP space, it is still unclear if a broker can continue to act as a QI for those holdings. Notwithstanding, we strongly suggest brokers to identify any non-PTPs and to get in contact with them in respect to any new documentation requirements, and to agree on a process to exchange certificates and to correctly apply withholding on the amount realized or distributions made.