23.09.2025

6'

Approval of PQS as authorized 1042 e-Filer and Upcoming e-Filing Obligations

Due to the upcoming changes in the e-filing obligations of the Form 1042, PQS attained the required status as Electronic Return Originator and Transmitter with the IRS and is now able to file Form 1042 and its attachments electronically via the Modernized e-File Platform (MeF).

Below, we would like to inform you about the significant changes in the e-filing obligations of the Forms 1042 and 1042-S, which will have an impact on many filers such as Qualified Intermediaries (“QIs”), Qualified Derivatives Dealer (“QDDs”) and Withholding Foreign Partnerships (“WFPs”) as well as our new e-filing service for Form 1042 and its attachments.

E-Filing of Form 1042

On February 21, 2023, the IRS updated the requirements for electronic filing obligations for entities as follows:

The threshold for mandatory electronic filing of returns has been lowered from 250 returns per calendar year to 10 or more returns per calendar year.

To assess compliance with the 10-return threshold, the filer is now required to consider nearly all types of information returns collectively. Previously, each category of information return was evaluated independently to determine if the threshold had been reached.

If the filer is a WFP, they must e-file if they have more than 100 partners

Financial institutions must file Forms 1042 electronically, regardless of how many returns they submit each year.

As we previously informed, the updated prerequisites for electronic filing now require businesses to submit Form 1042 and its attachments electronically via the Modernized e-File Platform (MeF), beginning with the 2024 tax year for U.S. withholding agents and the 2025 tax year for QIs, QDDs and WFPs. The submission of Form 1042 and related documents must be completed using an XML file through the MeF platform.

Currently, the way the MeF system has been set up, a filer itself will generally not have access to it. The reasons for that are manyfold, an important one being that the system is not set up to allow taxpayers to file forms themselves, but instead that the system is used by third-party transmitters to file the forms on behalf of taxpayers.

PQ Solutions has become an authorized e-Filer with the IRS for the Forms 1042, 7004, 1120-F and the respective attachments

PQS has attained the required status with the IRS as Electronic Return Originator and Transmitter and is able to support QIs, QDDs, U.S. withholding agents and WFPs with preparing the Form 1042, Schedule Q (Form 1042), the accompanying Forms 1042-S (to substantiate the tax credit claimed in line 67 of the Form 1042) and the Form 7004 in the correct format and filing it with the IRS on behalf of the filer.

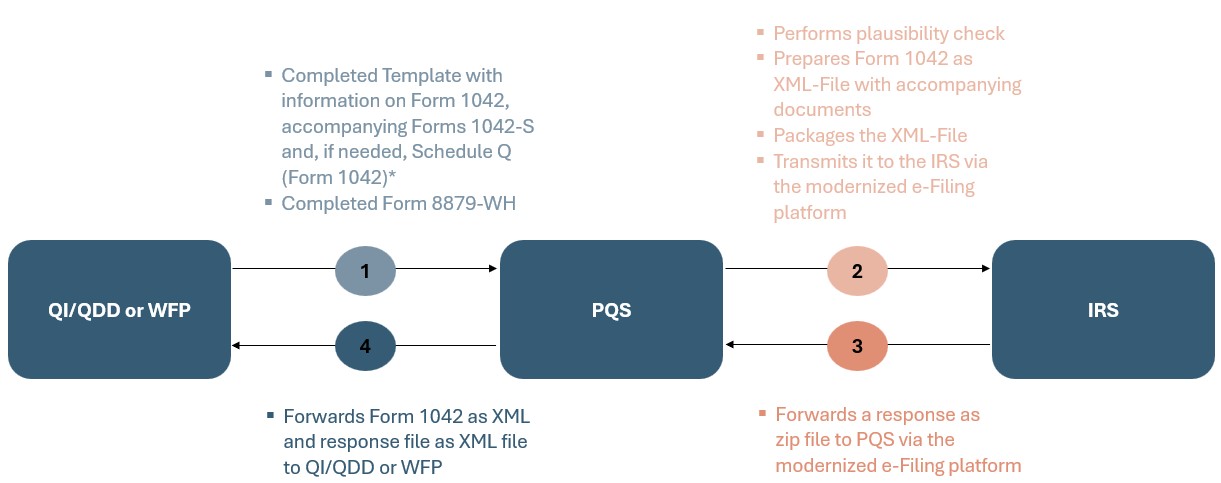

The following graphic illustrates the process for utilizing our e-filing service:

*QIs/QDDs, WFPs and our U.S. clients with an agreement with PQS to provide reporting or reconciliation services do not need to forward a template with information on Form 1042 and attachments, as PQS has this information already.

If you are interested in engaging us for this service, please contact us. If you are already a valued client of our services, we will contact you within the next weeks separately.

1042-S Reporting: FIRE Retirement and new IRIS system

On June 16, 2023, we informed that the IRS plans to retire the FIRE platform for electronic transmission of 1042-S Forms and replace it with the Information Returns Intake System (“IRIS”). Recently, the IRS specified that, starting with filing season 2027 (for tax year 2026 onwards), the IRIS platform will be the only system allowed to file information returns, effectively announcing the retirement of the FIRE system by that date.

Within the FIRE system, Forms 1042-S are submitted using a .txt file format, while the IRIS system requires filings via a CSV file through the taxpayer portal (limited to a maximum of 100 forms) or through an XML file using the A2A (Application-to-Application) platform, which allows for the submission of more than 100 forms. Form 8809, used to request more time to file information returns, will also be submitted through IRIS.

Publication 5717 provides guidance on registering for a TCC to electronically submit information returns via IRIS. The roles available for selection are as follows:

Issuer - to be chosen if the taxpayer is submitting its own information returns

Transmitter - to be used for third parties transmitting in the name of taxpayers

Software Developer

The roles are not mutually exclusive, i.e. a taxpayer may apply for several roles with the IRS. As per Publication 5903, two responsible officials (“RO”) must be appointed for the application. The RO must have been authenticated through ID.me, possess a valid ITIN or SSN and give information on the U.S. citizenship status. A RO can appoint further authorized users to use the IRIS platform.

At present, as experienced with the “IR for TCC” system, IRIS appears to be unavailable to individuals who are not citizens of the United States.

PQS will attain at least transmitter status with the IRS. In the future, we will provide updates regarding our experience with the application process and clarify the types of services we can offer for QIs, QDDs, U.S. withholding agents and WFPs in connection with IRIS.